Asian shares are mixed after Wall Street sets more records for US stocks

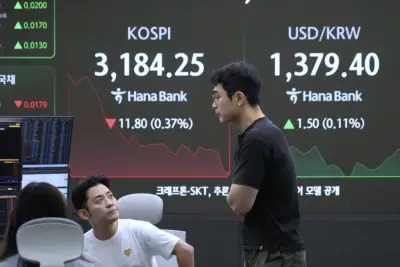

BANGKOK AP Stock markets in Asia were mixed on Monday after U S stocks rose to more records as they closed out another winning week U S futures and oil prices were higher ahead of exchange talks in Stockholm between U S and Chinese functionaries European futures rose after the European Union forged a deal with the Trump administration calling for tariffs on the bulk exports to the U S The agreement declared after President Donald Trump and European Commission chief Ursula von der Leyen met briefly at Trump s Turnberry golf unit in Scotland staves off far higher import duties on both sides that might have sent shock waves through economies around the globe Tokyo s Nikkei index lost to after doubts surfaced over what exactly the commerce truce between Japan and U S President Donald Trump especially the billion pledge of venture in the U S by Japan will entail Terms of the deal are still being negotiated and nothing has been formalized in writing explained an official who insisted on anonymity to detail the terms of the talks The official suggested the goal was for a billion fund to make investments at Trump s direction Hong Kong s Hang Seng index gained to while the Shanghai Composite index lost to Taiwan s Taiex rose CK Hutchison a Hong Kong conglomerate that s selling ports at the Panama Canal stated it may seek a Chinese investor to join a consortium of buyers in a move that might please Beijing but could also bring more U S scrutiny to a geopolitically fraught deal CK Hutchison s shares fell on Monday in Hong Kong Elsewhere in Asia South Korea s Kospi was little changed at while Australia s S P ASX rose to India s Sensex slipped Markets in Thailand were closed for a holiday On Friday the S P rose to setting an all-time for the fifth time in a week The Dow Jones Industrial Average climbed to while the Nasdaq composite added closing at to top its own record Deckers the company behind Ugg boots and Hoka shoes jumped after reporting stronger profit and revenue for the spring than analysts expected Its advancement was particularly strong outside the United States where revenue soared nearly But Intell fell after reporting a loss for the latest quarter when analysts were looking for a profit The struggling chipmaker also noted it would cut thousands of jobs and eliminate other expenses as it tries to turn around its fortunes Intel which helped launch Silicon Valley as the U S device hub has fallen behind rivals like Nvidia and Advanced Micro Devices while demand for artificial intelligence chips soars Companies are under pressure to deliver solid improvement in profits to justify big gains for their stock prices which have rallied to record after record in contemporary weeks Wall Street has zoomed higher on hopes that President Donald Trump will reach business deals with other countries that will lower his stiff proposed tariffs along with the exposure that they could cause a recession and drive up inflation Trump has in recent times released deals with Japan and the Philippines and the next big deadline is looming on Friday Aug Apart from transaction talks this week will also feature a meeting by the Federal Reserve on interest rates Trump again on Thursday lobbied the Fed to cut rates which he has implied could save the U S cabinet money on its debt repayments Fed Chair Jerome Powell has announced he is waiting for more figures about how Trump s tariffs affect the market system and inflation before making a move The widespread expectation on Wall Street is that the Fed will wait until September to resume cutting interest rates In other dealings early Monday U S benchmark crude oil gained cents to per barrel Brent crude the international standard also added cents to per barrel The dollar rose to Japanese yen from yen The euro slipped to from Source